Car insurance costs by state

Hey there, car enthusiasts! Looking to compare car insurance rates and costs? We've got you covered! Today, we're going to dive into a detailed comparison of car insurance rates by state. And guess what? We have some eye-catching images that perfectly illustrate the topic. So, let's get started!

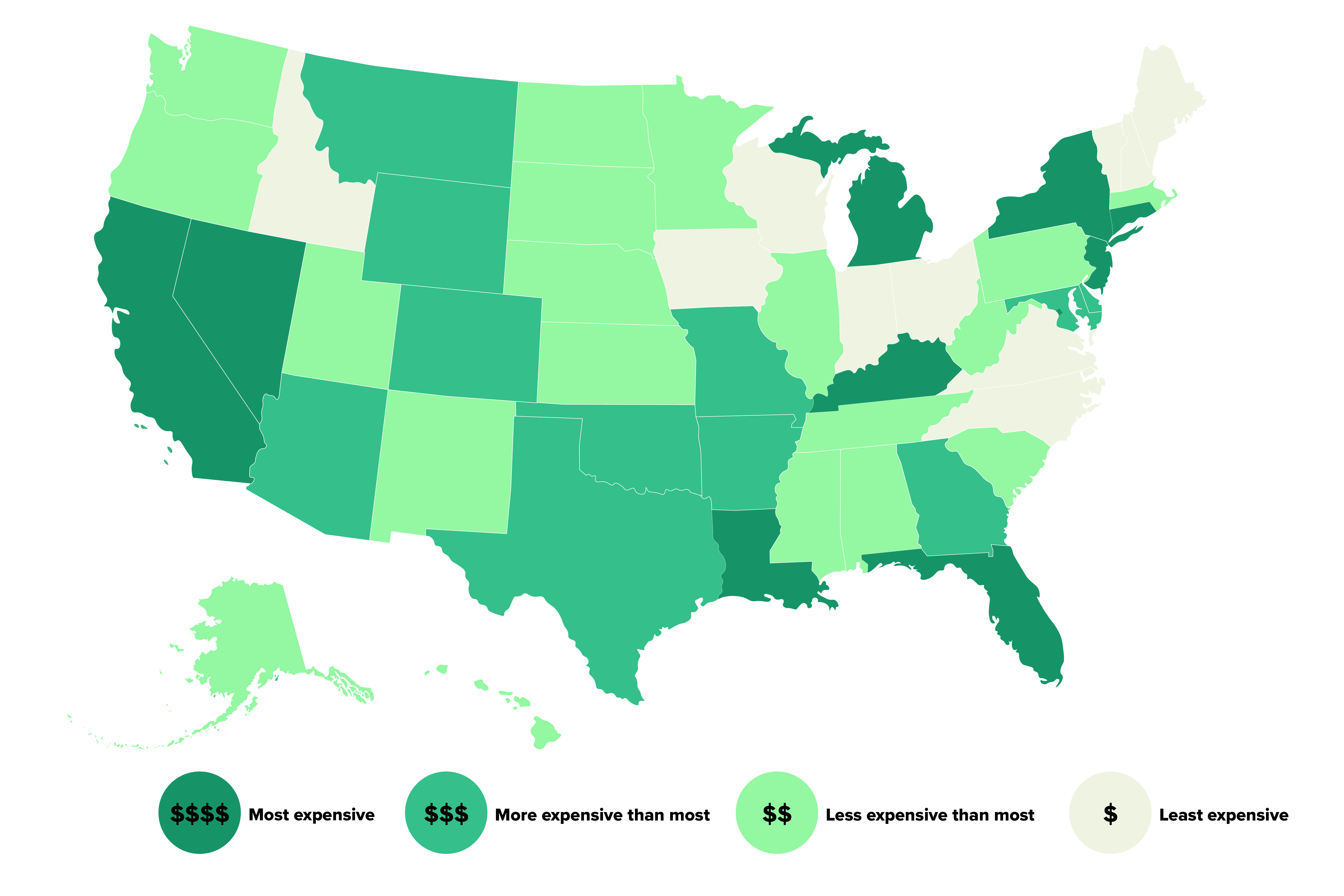

A Snapshot of Car Insurance Costs by State

As car owners, we all know that car insurance is a necessary expense. But have you ever wondered how car insurance rates vary from state to state? Well, we have some fascinating data that sheds light on this very subject.

Check out this chart below that showcases the average car insurance premiums in different states:

Whoa! It's quite evident that car insurance costs are not the same across the United States. Factors like traffic density, crime rates, average vehicle value, and even weather conditions contribute to this variation. Whether you're a frugal car owner looking for affordable coverage or a speed enthusiast ready to take on higher premiums, it's important to understand the cost differences between states.

Comparing Car Insurance Rates

Now that we've had a glimpse of car insurance costs by state, let's dive deeper into comparing rates. We'll walk you through a comprehensive analysis of various aspects that can impact your car insurance premium.

Factors Affecting Car Insurance Premiums

Your car insurance premium depends on a multitude of factors. Here are some primary aspects that insurance providers consider when determining your rates:

- Type of Coverage: The type of coverage you choose, whether it's liability coverage, collision coverage, or comprehensive coverage, plays a significant role in determining your premium.

- Driving History: Your driving record, including any accidents, violations, or claims, can impact your premium. A clean driving record can help lower your rates.

- Age and Gender: Statistics show that younger and male drivers tend to have more accidents, so insurance providers often charge higher premiums for these demographics.

- Vehicle Type: The make, model, and year of your vehicle can influence your premium. Cars with higher safety ratings often have lower premiums.

- Deductible: The deductible is the amount you're responsible for paying before your insurance coverage kicks in. Higher deductibles generally result in lower premiums.

- Credit Score: In several states, insurance providers may consider your credit score when calculating your premium. A good credit score can save you money on car insurance.

Understanding these factors can give you an advantage while comparing car insurance rates. Let's go one step further and explore some key tips to help you find the best possible rates for your car insurance needs.

Tips for Securing the Best Car Insurance Rates

1. Shop Around: Don't settle for the first insurance provider you come across. Take the time to compare rates from multiple companies. Each insurer has its own criteria for determining rates, so shopping around can save you a substantial amount.

2. Consider Car Insurance Discounts: Inquire about potential discounts you may be eligible for. Some common discounts include safe driver discounts, multi-policy discounts (if you have multiple policies with the same insurer), and low mileage discounts.

3. Opt for Higher Deductibles: As mentioned earlier, choosing a higher deductible can help reduce your premium. Just ensure you have enough funds set aside to cover the deductible in case of an accident.

4. Improve Your Driving Skills: Completing a defensive driving course or other recognized training programs can demonstrate your commitment to safe driving and potentially lead to lower insurance rates.

5. Consider Usage-Based Insurance: Some insurers offer usage-based insurance programs where they monitor your driving habits through a device installed in your vehicle. If you're a safe driver, you can earn significant discounts.

These tips can assist you in finding the best rates for your car insurance. Remember, it's important to review your coverage needs and determine the right balance between cost and protection.

Choosing the Best Car Insurance for You

With so many insurance providers and policies available, choosing the best car insurance for your needs can be overwhelming. To simplify the process, follow this step-by-step guide:

1. Assess Your Coverage Needs:

Start by evaluating your needs. Assess the value of your vehicle, consider your budget, and determine the level of coverage required based on your state's regulations. This will help you narrow down your options.

2. Research Reputable Providers:

Next, research reputable insurance providers that offer coverage in your state. Look for companies with good customer reviews, financial stability, and a reliable claims process.

3. Compare Quotes:

Reach out to multiple insurance providers and request quotes based on your coverage needs. Make sure to provide consistent information to get accurate comparisons. Online comparison tools can also be helpful in this process.

4. Review Policy Details:

Once you receive quotes, carefully review policy details. Understand the coverage and exclusions, policy limits, deductibles, and any additional benefits or add-ons. Ensure the policy aligns with your needs.

5. Check for Discounts:

Ask the insurance providers about available discounts. As mentioned earlier, discounts can significantly reduce your premium. Look for options such as safe driver discounts, good student discounts, or discounts for bundling multiple policies.

6. Good Customer Service:

Consider the customer service reputation of each provider. Check reviews and ratings to ensure that the insurance company has a track record of providing excellent customer support.

7. Finalize Your Decision:

Based on your research, quotes, policy details, and customer service reviews, finalize your decision. Choose the insurance provider that offers the best combination of coverage, price, and customer satisfaction.

Remember, car insurance is not just about the rates. It's crucial to select a provider that offers reliable customer service and a smooth claims process in times of need. The cheapest policy may not always be the best option for you.

Exploring Additional Tips for Saving on Car Insurance

While comparing rates and choosing the right car insurance provider are vital steps, there are more ways to save on your premiums. Let's take a look at some additional tips that can help you cut down on car insurance costs:

1. Maintain a Good Credit Score:

As mentioned earlier, many insurance providers consider your credit score when determining your premium. Pay your bills on time, maintain low credit card balances, and keep an eye on your credit report to improve your creditworthiness.

2. Bundle Your Policies:

If you have other insurance policies, such as homeowners or renters insurance, consider bundling them with your car insurance. Insurers often offer competitive discounts for bundling multiple policies.

3. Adjust Your Coverage:

If you have an older vehicle with a low market value, you might consider dropping collision coverage. However, carefully weigh the potential savings against the risk of having to cover repair costs in case of an accident.

4. Drive Fewer Miles:

The less you drive, the lower your risk of accidents. Many insurance providers offer discounts for low-mileage drivers, so if you have the option to cut down your mileage, do so.

5. Install Safety Features:

Equip your car with safety features such as anti-theft devices, airbags, and anti-lock brakes. These safety measures can help reduce the risk of accidents and, in turn, lower your insurance rates.

6. Avoid Ticketable Offenses:

This may seem obvious, but it's worth emphasizing. Avoiding traffic tickets, violations, and accidents not only keeps you safe on the road but also helps maintain a clean driving record, which can result in lower premium rates.

Conclusion

Wow, we've covered a lot today! From a detailed look at car insurance costs by state to exploring tips for securing the best rates, we hope this comprehensive guide has empowered you with the knowledge to make informed decisions. Remember to shop around, compare quotes, and consider various factors while choosing the best car insurance policy for your needs.

Car insurance is a critical aspect of car ownership that provides financial protection and peace of mind. By understanding what influences car insurance rates and employing smart strategies, you can save money without compromising on coverage.

Stay safe on the road and protect your beloved vehicle with the right car insurance. Happy driving!

Post a Comment for "Car insurance costs by state"